Global Equity Funds See Massive Outflows as Market Volatility Rises

Global equity funds have faced significant withdrawals, with investors pulling out nearly $8 billion over the past week amid heightened market uncertainty. The move marks one of the largest outflows in recent months, signaling a growing risk-off sentiment among global investors.

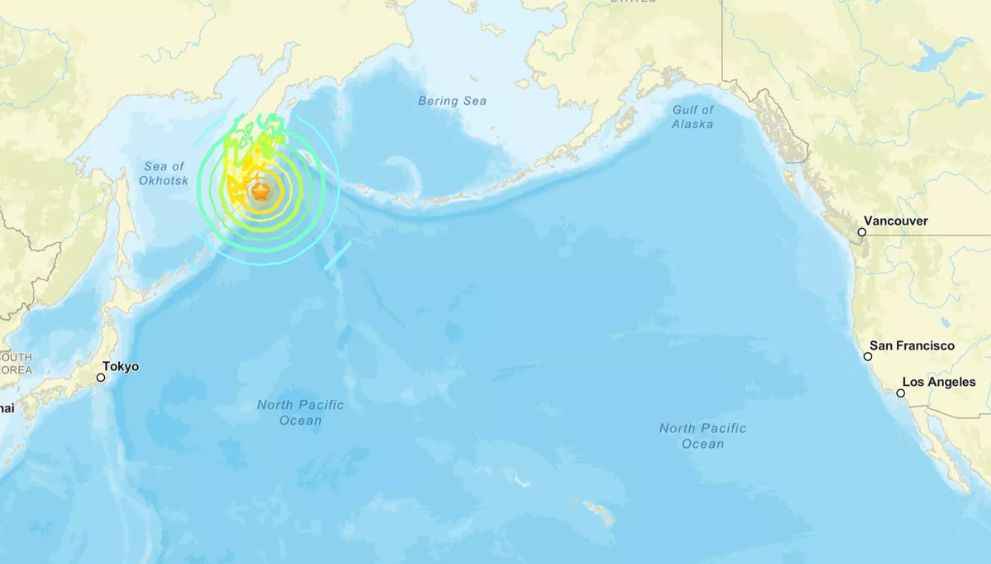

According to market data, U.S. equity funds were among the hardest hit, recording over $5 billion in net withdrawals. European equity funds also saw substantial outflows, while Asian markets witnessed a more modest retreat. Analysts attribute the trend to rising concerns over global economic growth, ongoing geopolitical tensions, and fluctuating interest rate expectations.

Meanwhile, investors have been shifting toward safer assets, with money market funds and government bonds witnessing increased inflows. The pullback comes as major stock indexes worldwide have experienced steep declines in recent sessions, driven by fears of slowing corporate earnings and potential recessions in key economies.

Financial experts warn that continued volatility could lead to further fund withdrawals in the coming weeks unless macroeconomic indicators show signs of stability.

Quick Take

| Metric | Value |

|---|---|

| Global equity fund outflow | $7.82 billion (week ending Aug 6) |

| Previous week outflow | Nearly $30 billion |

| Top inflow destinations | Money market ($135B), Bond funds ($21B) |

| Regional highlights | U.S. equities down, Europe & Asia modest inflows |

English

English