Market Optimism Boosted by Steady U.S. Inflation

The latest U.S. inflation report has brought a wave of relief across global markets. Inflation for July came in at 2.7% year-over-year, exactly matching June’s figure and slightly better than analysts predicted. Core inflation — which leaves out food and energy prices — ticked up just a little to 3.1%.

This stability has fueled hopes that the Federal Reserve will finally start cutting interest rates, with many investors betting on a half-point rate cut in September.

How Markets Reacted

In the U.S.:

- Wall Street celebrated the news. The Dow Jones jumped by 483 points, the S&P 500 hit new highs, and the Nasdaq saw strong gains.

- The rally was driven by optimism that borrowing costs will soon be lower, boosting corporate profits and economic growth.

Around the World:

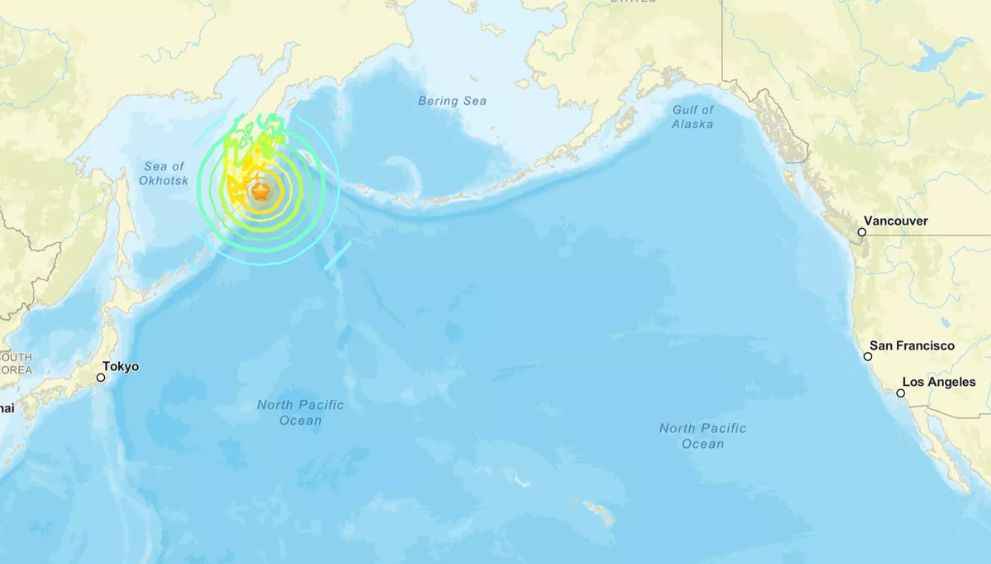

- Asian markets joined the party. Japan’s Nikkei broke records, Hong Kong’s Hang Seng rose nearly 2%, and South Korea’s Kospi posted solid gains.

- In India, the Sensex and Nifty surged in early trading, riding the wave of positive global sentiment.

Bonds & Currency:

- U.S. Treasury yields dipped as investors priced in easier monetary policy ahead.

- The U.S. dollar softened against major currencies, making it cheaper for other countries to trade in dollars.

Voices from Policy

U.S. Treasury Secretary Scott Bessent urged the Fed to go big with a half-point rate cut, adding fuel to market expectations. His comments further boosted investor confidence, sparking another round of buying in global equities.

Why It Matters

Steady inflation means the Fed can start lowering interest rates without risking another surge in prices. Lower rates reduce borrowing costs for businesses and households, encouraging spending and investment.

In simple terms — if you’re a business owner, a homebuyer, or an investor, the outlook just got brighter.

English

English